In our previous analysis we have captured how Sobha Green Acres, which can cater to the aspirational needs of the burgeoning mid income professionals at an economic price could be game changer in the Indian Silicon valley’s realty market. In this analysis we will capture the project which involves a slew of 6000 apartments, ranging between 650-1200 sqft, also offer suitable investment opportunities. Here are the lists of reasons suggested by our property experts; that make the project a hot cake for investment.

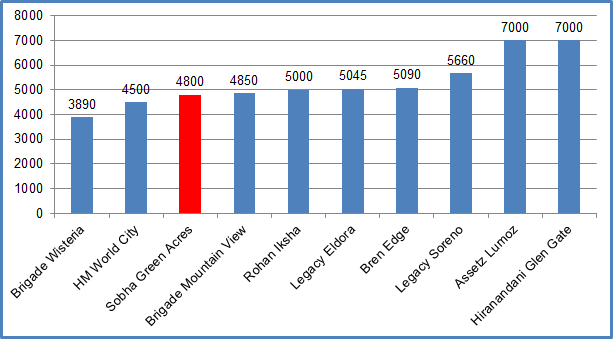

- Moderate Price: Compared with some of the popular residential projects in the Bangalore city, it could be seen that Sobha Green Acre project is moderately priced, which makes it a suitable investment opportunity.

- Key Location: The project will be developed in the Balagere road, which is touted as one of the fastest emerging real estate markets of Bangalore. The location is connected by four major roads namely Sarjapur Road, Outer Ring Road (ORR), Varthur Main Road and Marathalli. Capitalizing on the rapidly emerging IT industry in the close vicinity, Balagere has witnessed a huge surge in residential demand and will continue to do so in the coming time.

- Strong Vicinity: Key locations in the vicinity of the project involve, Bellandur, Varthur and Sarjapur, which are again known as some of the rapidly growing markets of Bangalore due to surge in IT and ITES industries in the recent time. The growth in the IT and ITES industry has also stimulated growth in the retail and hospitality industry in the region, thereby adding further value.

- Infrastructure: The nearby location of the project is also witnessing slew of infrastructure projects such as metro, road links and Chennai Bangalore Industrial corridor. Not to mention the 30 million sqft of office space, which is expected to join Whitefield in the coming time- a location not very far off from the project.

Based on the factors mentioned above, Sobha Green Acres is one of the hot investment projects in the Bangalore at the moment. Not only the project is moderately priced, but on the backdrop of a rapidly evolving locality and infrastructure projects, it can be concluded that the project can witness an annual appreciation of 13-15% in the next 3-5 years. Likewise given the large volume of IT and other professionals working in the nearby location, the rental can experience an annual surge of 4-6% in the next 3-5 years.

Read more: Lodha Belmondo Pune Project Review