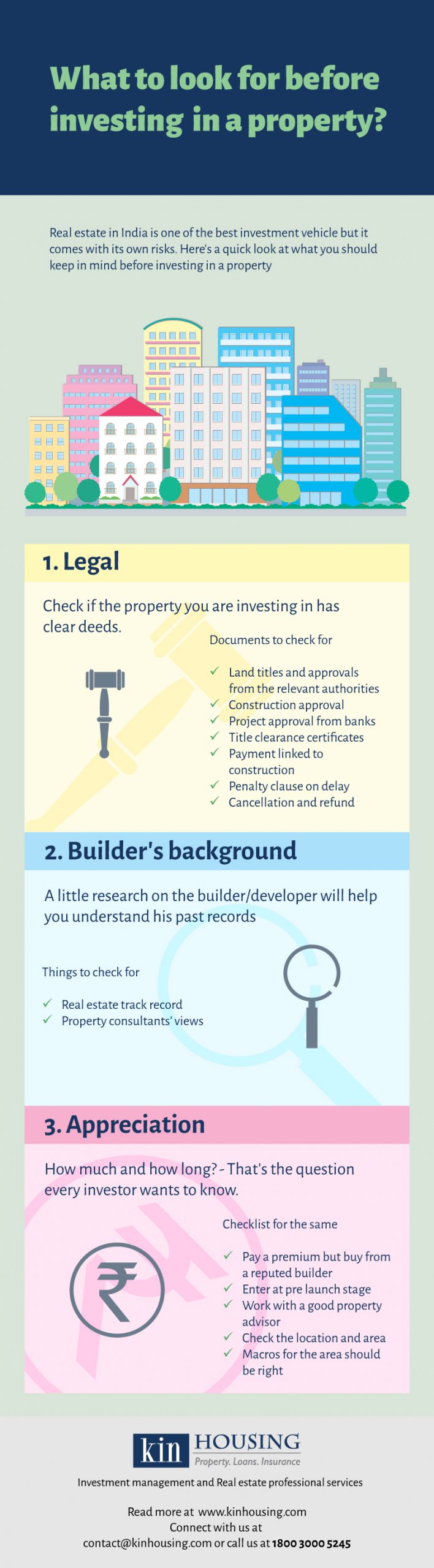

What to look before buying a property?

INTRODUCTION

Buying a property – In our infographics series, here’s a quick checklist one should go through before Buying a property. This covers legal check, builder’s background and how the appreciation for the property is expected. What to look for before buying a property :

APPROVAL AND LICENCES

Before buying a property, once you zero in on the property, check the builder’s paperwork ranging from commencement certificate for work, environmental clearance and approved building plans. Also ask for the status of the land title and see if the builder has bought the land or has just development rights for it. Here is a list of documents you should check.

(a). Title Deed: Check whether the builder has a right over the prope rty. While buying a plot, see the title deed of the land to confirm if the builder has the full right to it. You can also take help from a lawyer to get the deed examined. Divakar Vijayasarathy, Co-founder, MeetUrPro.com, says, “A mere NOC (no-objection certificate) from the panchayat or the local body does not constitute approval by the authority.”

(b). Release Certificate: If you are buying a property in resale, remember that it may have been pledged to get a bank loan. In such a case, you will have to get a release certificate from the bank, which will prove that the loan on the land has been repaid. Check Encumbrance Certificate: It is also important to verify that the land is free from all legal dues.

(c). Verify land use: Verify the land-use zone as per the city master plan for the plot. You can get the plan from the local body office in your respective city.

(d). Approvals by Local Body: Make sure that the entire layout has been approved by the development corporation and the local body of the city.

(e). Property Tax Receipts: If you are buying a property in resale, ask for previous property tax receipts from the seller along with other bills. This way you can ensure there are no pending bills.

LIST OF BANKS FINANCING THE PROJECT

With real estate companies sitting on unsold inventory and not having enough cash to complete their projects, banks have become vary of financing them. There are many builders which do not get bank loans at all. So, once you finalise the property and confirm that all approvals are in place, find out banks which are ready to fund the project and go with the one offering you loan at the lowest rate.

CALCULATE THE TOTAL COST

Do not go by what the broker tells you. Many times brokers just mention the basic cost and not other factors such as internal/external development fees, preferential location charges, parking/club/statutory charges, and service tax, which escalate the total cost. Ask for the final cost of the property.

VERIFY THE BUILDER

The piece of land in question may be under litigation. Hence, it is recommended that you do an extensive verification of the builder. You could verify its past or current projects or even post queries on the various online real estate forums.

BUY VS RENT

Many people buy a property thinking they will use rent to pay EMIs. Experts say it is a wrong approach. Surabhi says, “Do not over-leverage in hope that rental income will pay for the EMI. The rental yield on residential properties is generally only 2-3 per cent.” Moreover, the property may remain vacant for months before you can find a tenant.

THE RIGHT PLAN

There are various payment options available in the market such as down-payment plan, flexi-payment plan, construction-linked plan and possession-linked plan. Experts say one must choose carefully, as generally there is a cost for every convenience. For example, in subvention schemes, the price is at least 10 per cent higher than what is charged under regular schemes. Customers must also understand that any late payment or default on the part of the builder in such schemes will impact their credit history. Then, there are guaranteed rental schemes under which the developer either pays you rent for a fixed period during construction or for a certain period after possession. In the first scheme, the buyer gets regular payments from the developer during the construction of the house, which helps him offset a part of EMI or rent costs. In the latter scheme, generally for properties which are outside city limits, the developer offers rental income after possession. But the fine print is that there is no guarantee.

SIZE OF THE APARTMENT

Builders generally mention super built-up area in brochures. This includes common areas such as staircase, lobby, etc. The carpet area of the flat could actually be 30 per cent less than the super built-up area. For example, a two-BHK 1,000 square feet flat could actually be just 700-750 square feet. It is advisable to always go by the carpet area, the area enclosed within walls. Divakar says, ” If you are looking to buy a plot for living at a later stage, it is advisable to first understand your requirement. Ensure that you check how much land (built-uparea) you will need to build your dream home. Topography and soil are the other vital factors.”

CHECK THE INFRASTRUCTURE PLANS

Metro connectivity or any other big infrastructure development in future linked to the location of the property you intend to purchase can boost the return on investment tremendously. Also, ensure that the property is not close to any polluting industry.

CHECK THE SITE

The layout in the brochure could be different from the reality. So, do a thorough site visit before booking the property. Interact with people in the neighbourhood as they may know about any illegal occupation or other legal disputes related to the property.

REGISTER YOUR PLOT

After selecting the property, you have to register it with the authority concerned for you to become its lawful owner. Surabhi says, “Through registration of sale deed, a person is able to acquire the rights of the property from the date of the execution of the deed.”Last, but not the least, do some research about the developer’s record in terms of total square feet developed, market feedback and project delays. Also, check the quality of its previous projects. Divakar says, “Be sure to search for any contingencies which may hinder the development of the property. For this, you can probably refer to or participate in various online real estate forums.

Read more: How’s Real Estate Market is Doing in India in 2022

One Comment on “What To Look Before Buying A Property?”